What is down payment for a mortgage and how much does it cost in Serbia?

- What is the down payment amount for a mortgage?

- Most favorable mortgage loans on the market

- Reduced down payment for buying the first apartment

- Mortgage without down payment

- Conditions you need to meet

- Documentation when applying

Buying your own home is one of the most important steps in life, and a mortgage is often a key factor in realizing that dream. If you don't have cash to buy real estate or assets to sell, you're probably considering borrowing from a bank.

A home loan is a significant financial commitment over many years, but many see it as practical because it offers opportunities that are not easily affordable through savings alone. More importantly, it allows you to acquire your home much earlier than if you were saving up over many years.

However, taking out a mortgage requires initial financial investment. Therefore, in this text, we will delve into the down payment for a housing loan in detail. We have explored various options that banks offer regarding the participation amount. This way, you can make an informed decision and buy a property that suits both your needs and financial capabilities.

What is the down payment for a mortgage?

It is the initial amount of money that the borrower must deposit to the seller of real estate for the mortgage to be approved. This amount, which varies from bank to bank, typically amounts to around 20% of the total value of the property you intend to buy. For example, if the price of an apartment is €100,000, the buyer would need to provide €20,000 upfront to continue with the mortgage approval process.

This sum of money is sourced from the buyer's personal funds. Gathering the initial amount can be challenging, but since the down payment reduces the debt owed to the bank, it is advisable to gather and deposit as much as possible to lower the monthly installment. Often, those who already own property in their name decide to sell it and use the amount to assist in buying a new property.

If you haven't gathered the amount for the down payment or have no other property, there are options that can help ease this demanding financial situation.

One such solution is to apply for a special cash loan intended to secure funds for applying for a mortgage, or someone with whom you plan to live in the new home can do this. Before making this decision, it is important, of course, to determine whether the repayment obligations of the cash and mortgage loans will be manageable for the household budget.

Can down payment for a housing loan be reduced?

The benefit of reducing the participation is available to those who are buying and registering property in their name for the first time. In this case, many banks require a percentage of 10% instead of the standard 20%, thus making it easier to acquire the first apartment. Not all banks practice this, but there are those that offer such an option. Although a lower participation is welcome, it results in a slightly higher monthly mortgage installment, yet this is still a preferred repayment method among clients.

Another advantage when buying the first apartment is the VAT refund. Find all about the required documentation in our article on this subject.

Most favorable mortgage loans on the market

As the first step, we advise you to thoroughly inquire with a Credit Advisor about the current market conditions for housing loans and which approach is best for your individual situation. A team of banking experts will guide you to the most favorable offers from banks for free.

Your advisor will consider whether it is profitable to buy a property through a mortgage at this time or to wait for more favorable bank conditions. This will largely depend on the tendencies of interest rates on the market. In 2024, the latest economic reports and the direction of monetary policy unambiguously indicate that interest rates will start to decline in the middle of the year, while mortgage loans are already noticeably more favorable compared to 2023.

Can you get a house loan without down payment!?

At this time, no bank approves a mortgage without down payment, but it is possible to receive certain concessions, such as paying 10% of the amount (even if you are not buying a property for the first time!) on condition that you put another property you own under mortgage as collateral for your mortgage.

Even if you are not a property owner, in agreement with parents or other individuals, a mortgage can be registered on their property as collateral for your mortgage.

The condition is that the value of the property under mortgage must be appraised by a professional appraiser at least 30% higher than the borrowed amount. It is also necessary that the property has no existing mortgages. You can check this detail at any time on the state website eKatastar when you decide on a specific property and find precise information about its address.

This option implies that you will mortgage both the existing property and the new one you are buying for the mortgage. In other words, the first mortgage is for the down payment you haven't paid, and the second mortgage covers the remaining mortgage amount.

Certainly, this option may be suitable in certain cases because it allows you to leverage the value of the property you already own to facilitate the purchase of a new one, especially if you plan to live in one and use the other as an investment.

Conditions for the housing loan in Serbia

To borrow money from a bank to buy property, you need to meet certain criteria. These conditions concern the age of the borrower, monthly income, employment over the last six months. Specifically, you must have been in continuous employment for at least six months with your current employer and have a total work experience of at least one year.

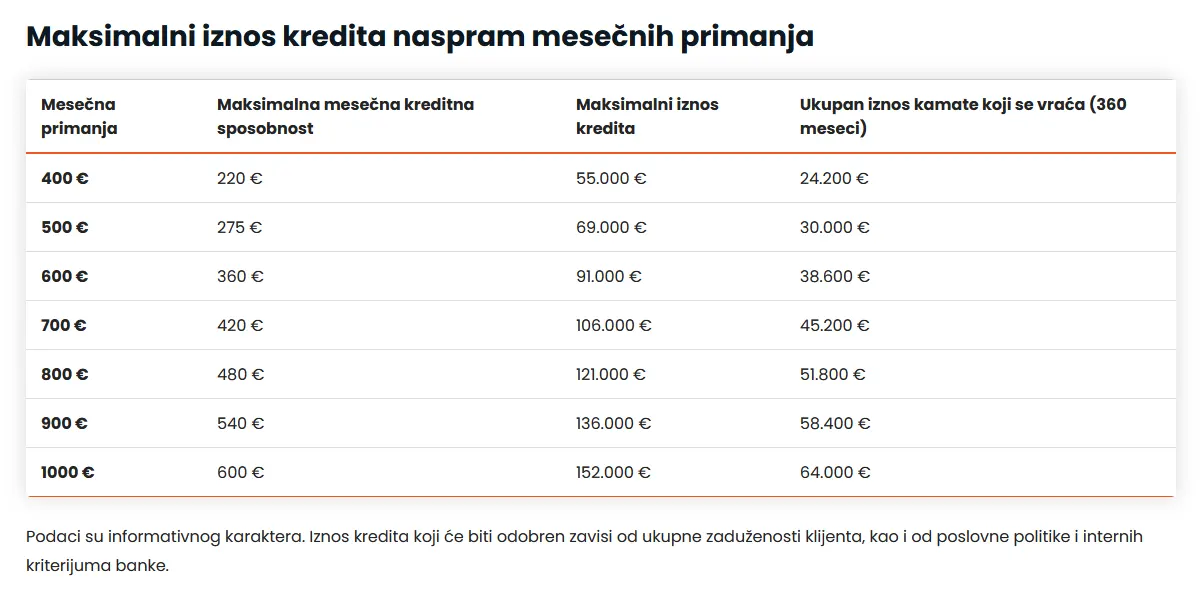

The bank will also check whether your previous credit history is and whether you have the appropriate creditworthiness for the amount of loan you intend to take. For approximate guidance, see the table showing the maximum loan amounts based on your monthly earnings.

Documentation when applying for a mortgage in Serbia

The required documents that you need to submit to the bank when applying for a mortgage depend on your choice of property, whether it is under construction or existing, and whether the property is registered or not. The bank may request additional documentation during the analysis and consideration of the mortgage application, but these are the basics you need to prepare.

Employer verifies:

- Employment confirmation;

- Administrative attachment in 2 copies;

- Pay slips for the last 6 months.

The bank issues:

- Transaction history from your current account for the last 6 months from the bank where you receive your salary.

Documentation regarding the property you are purchasing:

- Proof of acquisition of real estate - purchase contract, inheritance resolution, purchase agreement...;

- Real estate deed not older than 15 days;

- Property valuation by an authorized bank appraiser;

- Identification documents of the seller and spouse if the property was acquired in marriage;

- Complete construction documentation (for properties purchased from developers under construction).

Buying real estate without commission in Serbia

When you decide to take such a big step as buying your own apartment, you want the procedure to go smoothly, securely, and, of course, without unnecessary costs. The business policy of the City Expert real estate agency is based on providing free services to apartment buyers, which means there is no agency commission, and you only pay the price of the property, transparently displayed in the advertisement. Our experienced agents and lawyers will handle the entire legal verification and support process, prepare the purchase contract, and negotiate the price if necessary.

If solving your housing issue is current for you, browse through the largest selection of properties across Belgrade, Novi Sad, Nis by selecting parameters that suit you, such as price, location, square footage, and other important filters. Listings are updated daily due to diverse supply and intense demand, so we are confident you will find a home that suits you perfectly!